INTRODUCTION

This report aims to provide a comprehensive analysis of the growing significance of e-invoicing within the European financial landscape. As businesses across Europe navigate the digital transformation of financial processes, understanding and leveraging e-invoicing has become paramount to ensure operational efficiency, regulatory compliance, and cost savings.

With 25 years of existence and 8 years of proven business expertise in e-invoicing, honed through collaboration with our esteemed client, Tradeshift, Setronica has not only mastered the intricacies of the industry, but has also embraced the ever-evolving trends. Setronica’s decision to research the market was fuelled by a passion to stay at the forefront of technology and provide modern solutions that redefine the invoicing landscape, ensuring efficiency and excellence for our users.

OBJECTIVES OF THE REPORT

The report is designed with the following objectives in mind:

- To understand the e-invoicing landscape: Provide a clear definition of e-invoicing and outline its goal within the context of financial operations and regulatory compliance.

- To analyse regulatory preconditions: Examine the regulatory environment across Europe, highlighting country-specific mandates and the timeline for e-invoicing adoption.

- To assess market dynamics: Explore the size, growth, and segmentation of the e-invoicing market, including the impact of COVID-19 and identifying key trends shaping the future of e-invoicing.

- To evaluate technological and market players: Delve into the technological infrastructure that supports e-invoicing and conduct a competitor analysis to understand the competitive landscape.

- To guide transition strategies: Offer actionable insights and guidance for businesses looking to transition to e-invoicing, ensuring a smooth adoption process that aligns with European standards.

WHAT IS E-INVOICING?

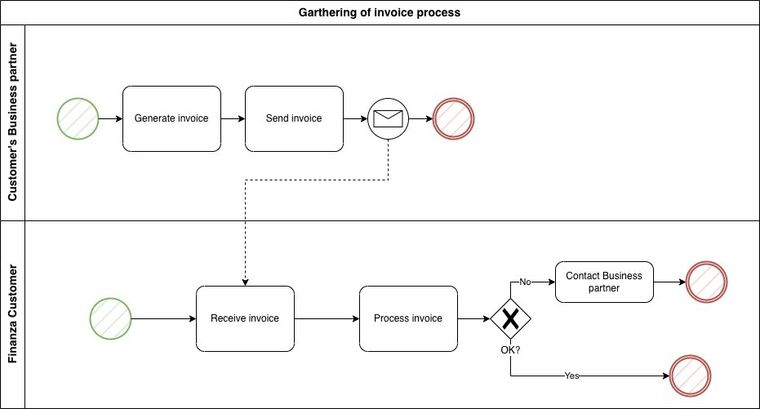

Receiving e-invoices business process

Electronic invoicing is the exchange of an electronic invoice document between a supplier and a buyer. An electronic invoice (e-Invoice) is an invoice that has been issued, transmitted and received in a structured data format which allows for its automatic and electronic processing, as defined in Directive 2014/55/EU.

The European Committee for Standardization (CEN) developed standard EN-16931 for electronic invoicing at the request of the European Commission following the Directive 2014/55/EU.

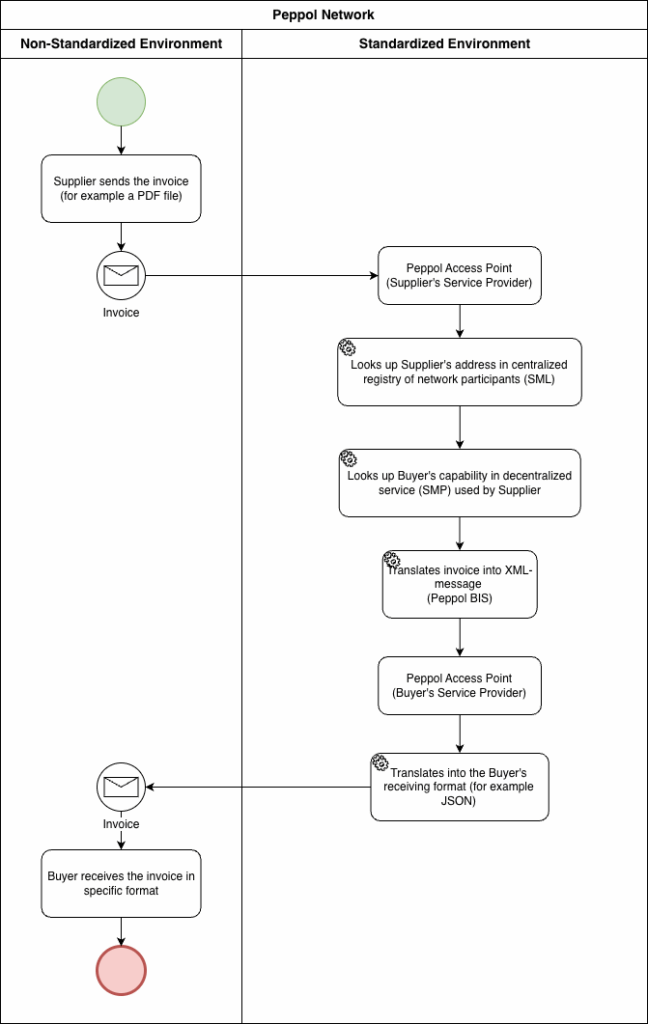

Sending e-invoice to Customer from Non-Standardized format to Standardized one

THE GOAL OF E-INVOICING IN MODERN FINANCE

On 8 December 2022, the European Commission made the VAT in the Digital Age (ViDA) regulatory proposal which contained VAT reforms, including an EU real-time digital reporting requirements (DRR) based on e-invoicing. The idea was to reduce EU-wide VAT revenue loss known as the ‘VAT Gap’ which amounted to €93 billion in 2020 according to HJK Auditors.

REGULATORY PRECONDITIONS FOR E-INVOICING IN EUROPE

The landscape of e-invoicing in Europe is diverse, with various countries at different stages of implementing electronic invoicing mandates. This section explores the regulatory preconditions and implementation timelines for e-invoicing across several European countries, with a focus on Serbia and Belgium, to provide a comprehensive understanding of the evolving e-invoicing ecosystem.

Serbia has embraced e-invoicing with a structured approach to enhance tax compliance and streamline business transactions. Since 1 January 2023, e-invoicing has been mandatory for all B2B (Business-to-Business) transactions, following the introduction of the Continuous Transaction Controls (CTC) model. This model facilitates the creation, issuance, sending, receiving, processing, and storage of e-invoices through a central clearing system, ensuring adherence to the Serbian Standard on Electronic Invoicing.

Belgium is poised to introduce mandatory B2B e-invoicing and e-reporting from July 2024. The country’s finance minister has outlined the plan, which is likely to be implemented through Peppol. The rollout will be phased, starting with large taxpayers being required to issue e-invoices in July 2024, followed by medium-sized taxpayers in January 2025, and finally extending to all taxpayers by July 2025. This phased approach is in line with the EU guidelines set out in the ViDA framework, which promotes interoperability between data exchange systems in EU Member States.

The adoption and implementation of e-invoicing mandates vary across Europe, with countries at different stages of readiness and execution:

- Albania and Turkey were among the early adopters, with e-invoicing mandates in place since January 2021 and January 2014, respectively.

- Spain has implemented live invoice and book reporting since July 2017 and is planning to introduce pre-clearance B2B e-invoices by July 2025.

- France is set to roll out e-invoicing and e-reporting for B2B and B2C transactions by September 2026.

- Croatia, like Belgium, plans to mandate B2B e-invoicing by January 2026.

- Germany and Greece are working on proposals for mandatory B2B e-invoicing, targeting implementation between 2025 and 2028.

Several countries, including Denmark, Estonia, Finland, Latvia, Poland, Portugal, and Romania, have outlined plans or are in the process of consultations to introduce or expand e-invoicing requirements within the next few years

Chapters

- INTRODUCTION

- OBJECTIVES OF THE REPORT

- WHAT IS E-INVOICING?

- THE GOAL OF E-INVOICING IN MODERN FINANCE

- REGULATORY PRECONDITIONS FOR E-INVOICING IN EUROPE