PROJECT SUMMARY

INDUSTRY

Food delivery

Logistics

COLLABORATION

Outsourcing development

9+ years of collaboration

CHALLENGE

Adapt to changes in the tax system while handling thousands of daily orders.

TECH STACK

RESULTS

100%

compliance

100,000

daily transactions

In 2018, Saudi Arabia made a historic economic shift by introducing a value-added tax system. This fundamental change to the tax landscape caught many businesses unprepared, especially those with complex operations spanning multiple sectors.

Our client, a delivery company handling thousands of daily orders, faced an urgent compliance challenge with no established playbook to follow. What began as an unexpected challenge turned into an opportunity to support businesses through significant change in the Saudi market.

Adapting to VAT

Before 2018, Saudi Arabia had no VAT system at all. This was new territory for everyone.

Thankfully, our previous work with online marketplaces gave us valuable experience with tax systems. We already understood how tax rates can vary based on what you’re selling and where you’re selling it.

We quickly updated our client’s systems to handle the new tax requirements, focusing on three key areas:

- financial calculations,

- product catalogs,

- order management.

By responding rapidly to these changes, our client was able to keep their business running smoothly without any disruption, even as they adapted to the new tax environment.

New reporting requirements

Everything went smoothly until 2021, when a new regulator appeared in the Saudi Arabian market – ZATCA.

ZATCA stands for Zakat, Tax and Customs Authority. It’s the main tax regulatory body in Saudi Arabia, formerly known as the General Authority of Zakat and Tax (GAZT).

This new institution required reporting on all provided services and goods, as well as on taxes paid, in accordance with the received profit.

Considering that our client was both a seller of goods (merchant) and a service provider (intermediary between other merchants and customers), we needed to implement two types of reporting:

- Monthly reporting provided by all merchants

- Operational reporting of the company providing services

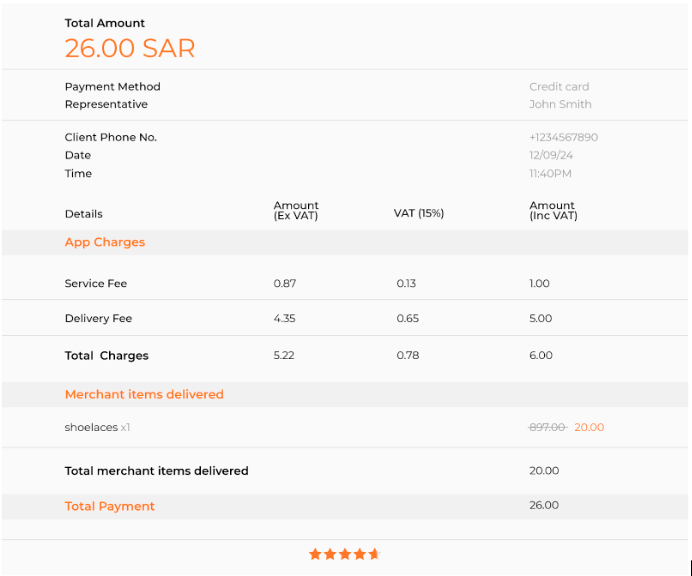

ZATCA also required that all customer receipts include all the data translated to Arabic, amounts, VAT amounts, and a special QR code. Customers could scan this QR code with their phones to verify two important things: that the business had properly reported the transaction to tax authorities and that they were charging the correct VAT amount.

Meeting two important needs: reports for ZATCA and receipts for customers

Our implementation required solving two interconnected problems. First, we needed to create tax files exactly how ZATCA wanted them and send these files to their system correctly.

At the same time, we had to make sure customers got their receipts right away with the correct data, including VAT amounts and working QR codes.

So, we split the project into several stages:

- Learning the rules

We needed to carefully study the requirements, develop and compile data mapping, verify amount calculation formulas with required accuracy, and present everything in the required format.

- Technical task of report formation

Determine how to form reports and establish the optimal timing for report generation. Timing was especially critical because documents needed to maintain a proper sequence. Each new document had to include a hash of the previous document, generated according to specific rules, creating an unbroken chain.

We also needed to determine which data to use as the foundation for these reports while seamlessly integrating our new solutions into the client’s existing system.

- Technical performance task

Ensure processing of large volumes of data at high speed. By that time, our client had about a hundred thousand orders per day, and the receipt had to be provided to the customer immediately after the order was completed despite the system load.

Real integration results for complex systems.

Get a free session to learn how we solve integration challenges.

We’ll get back to you within 1 business day to suggest possible next steps.

New challenges: QR codes, security, and the decimal point dilemma

We already knew how to work with large volumes of data at high speed, so displaying data for the client was not a big problem. However, meeting the regulator’s requirements proved more difficult.

In addition to new technical challenges, such as generating a QR code and hash chain of the documents that meets certain criteria for encrypting order data (supplier data, included goods, services, their cost, delivery addresses, and more) and complex authorization (given the confidentiality of financial data), we faced a rounding problem.

Each report sent to the regulator’s system was checked for compliance and calculation correctness. Not only did each line in the order have to display the corresponding VAT for the product or service, but the total amount, taking into account all discounts, had to correspond to the VAT established in the region.

Applying all the client’s promotional offers gave us a lot of trouble. Discounts could be provided simultaneously at several levels: at the level of an individual product, the delivery service, the entire shopping cart, or the entire order as a whole.

Depending on what the discount was applied to, the calculations differed, and each change affected the final amount, which had to match everywhere.

In general, we fully faced the rounding problem. We had to partially change the rounding methods used in our algorithms and, in some cases, even change the data type.

From basic implementation to functionality expansion

Our team was responsible for meeting the requirements in two different phases of this integration. For the regulator, this was also a new process, so they outlined their requirements for different phases.

We were given a month for each phase.

The first requirements were not easy to satisfy in this short timeframe, as we had to learn a lot and quickly implement technically sustainable solutions. The second phase was easier, as we were already in context, knew the data format perfectly, and only needed to expand and supplement the functionality implemented earlier.

By immersing ourselves in the project from the very beginning, we were able to quickly and effectively finalize it in accordance with the changed and newly added requirements.

Successful integration and a satisfied client

Ultimately, the integration with the regulator was successful. At the moment, there are no claims against our client from the regulator. Plus, our company became a leader in implementing new requirements in the market.

We were the first to satisfy all requirements, did it on time, with quality, and without any penalties or claims. Later, we were also able to help some of our merchants properly set up reporting on their data.

Conclusion

This story demonstrates our ability to quickly adapt to changing regulatory requirements and effectively solve complex technical problems. We are proud to have helped our client successfully transition to new tax realities and maintain their business.

This project showed how we can help businesses adapt quickly when tax rules change. We solved complex technical problems for our client, helping them meet all ZATCA’s requirements without disrupting their daily operations.

Our client not only avoided penalties but also became one of the first businesses to fully comply with the new system. We’re proud that we kept their business running smoothly during this major change.

Your business needs integration with regulatory systems? Contact us via the form below. We will help you adapt to any new requirements and ensure compliance with legislation.

Chapters

- Adapting to VAT

- New reporting requirements

- Meeting two important needs: reports for ZATCA and receipts for customers

- New challenges: QR codes, security, and the decimal point dilemma

- From basic implementation to functionality expansion

- Successful integration and a satisfied client

- Conclusion